Completing a restoration project on a historic or old house can come with a very large budget. This type of budget is typically beyond most families, and the upkeep costs of a home that has 20 or more rooms can be significant as well, which is why we often see these historic buildings turned into apartments or businesses. Recognizing that these buildings mean a lot to communities, historic tax credits have been created on both the national/federal and state levels to help owners restore these properties.

Historic tax credit programs come in many forms. The Federal Historic Tax Credit is the most well known.

How the 20% Federal Historic Tax Credit Works

Certified historic structures are eligible for a credit equal to 20 percent of the cost of rehabilitation. Properties built before 1936 that are not eligible for individual listing on the National Register of Historic Places, nor eligible for inclusion in a certified historic district (considered non-historic, non-contributing structures) are eligible for a credit equal to 10 percent of the cost of rehabilitation. The Federal Historic Tax Credit (HTC) encourages the preservation and reuse of the nation’s built environment by offering federal tax credits to the owners of historic properties. The tax credits represent a dollar-for-dollar reduction of federal taxes owed.

There are four keys to qualifying for the 20% Federal tax credit:

1. Must be on the National Register of Historic Places be certified as contributing to the significance of a “registered historic district”

2. The project must meet the “substantial rehabilitation test”

3. The rehabilitation work must be done according to the Secretary of the Interior’s Standards for Rehabilitation

4. After rehabilitation, the historic building must be used for an income-producing purpose for at least five years. Owner-occupied residential properties do not qualify for the federal rehabilitation tax credit.

As you can see, this program is quite involved. It has resulted in restoration of 38,000 historic properties representing nearly $100 billion in private investment. The projects have also created more than 85,000 jobs.

How the 10% Historic Tax Credit Works

The 10% tax credit is available for the rehabilitation of non-historic buildings placed in service before 1936. The building must be rehabilitated for non-residential use. In order to qualify for the tax credit, the rehabilitation must meet three criteria:

1. at least 50% of the existing external walls must remain in place as external walls

2. at least 75% of the existing external walls must remain in place as either external or internal walls

3. at least 75% of the internal structural framework must remain in place.

There is no formal review process for rehabilitations of non-historic buildings. Learn more about this credit in this tax incentive document.

State Historic Tax Credits

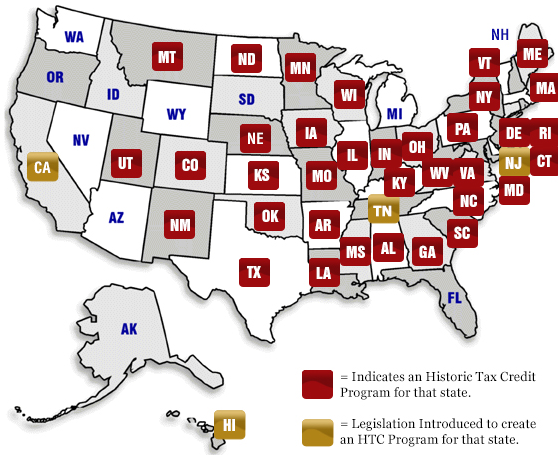

If you are looking to restore a home to live in, state historic tax credits are more likely to help. Each state decides if they will have their own program, and they can change from year to year. You can see if your state offers a historic tax credit here, most Eastern states do except New Hampshire and Washington DC at this time.

Let’s take a look at Virginia’s current historic tax credit program just as an example. In order to qualify a house can be used as a residence or income producing business, and must meet the following criteria:

1. Individually listed on the Virginia Landmarks Register, or

2. Certified as eligible for listing, or

3. Certified as a contributing structure in a historic district that is so listed

In order to qualify for the Virginia state credit, the rehabilitation expenses must be:

1. For owner-occupied structures, at least 25% of the assessed value of the buildings for local real estate tax purposes for the year before the rehabilitation work began.

2. For all other eligible structures, at least 50% of the assessed value of the buildings for local real estate tax purposes for the year before the rehabilitation work began

State tax credit amounts very widely, so it is always best to do your research before starting any rehabilitation project.

Other Structures

Some states also have historic tax credits for other structures, for instance New York has incentives for barns.

Tax Benefits for Historic Preservation Easements

Another tool for potential tax credits is a historic preservation easement. A historic preservation easement is a voluntary legal agreement, typically in the form of a deed, that permanently protects a historic property. Through the easement, a property owner places restrictions on the development of or changes to the historic property, then transfers these restrictions to a preservation or conservation organization. A historic property owner who donates an easement may be eligible for tax benefits, such as a Federal income tax deduction.

Easement rules are complex, so property owners interested in the potential tax benefits of an easement donation should consult with their accountant or tax attorney. Learn more about easements in Easements to Protect Historic Properties: A Useful Historic Preservation Tool with Potential Tax Benefits.